Top 5 Electronic Wallet (e-Wallet) in the Philippines

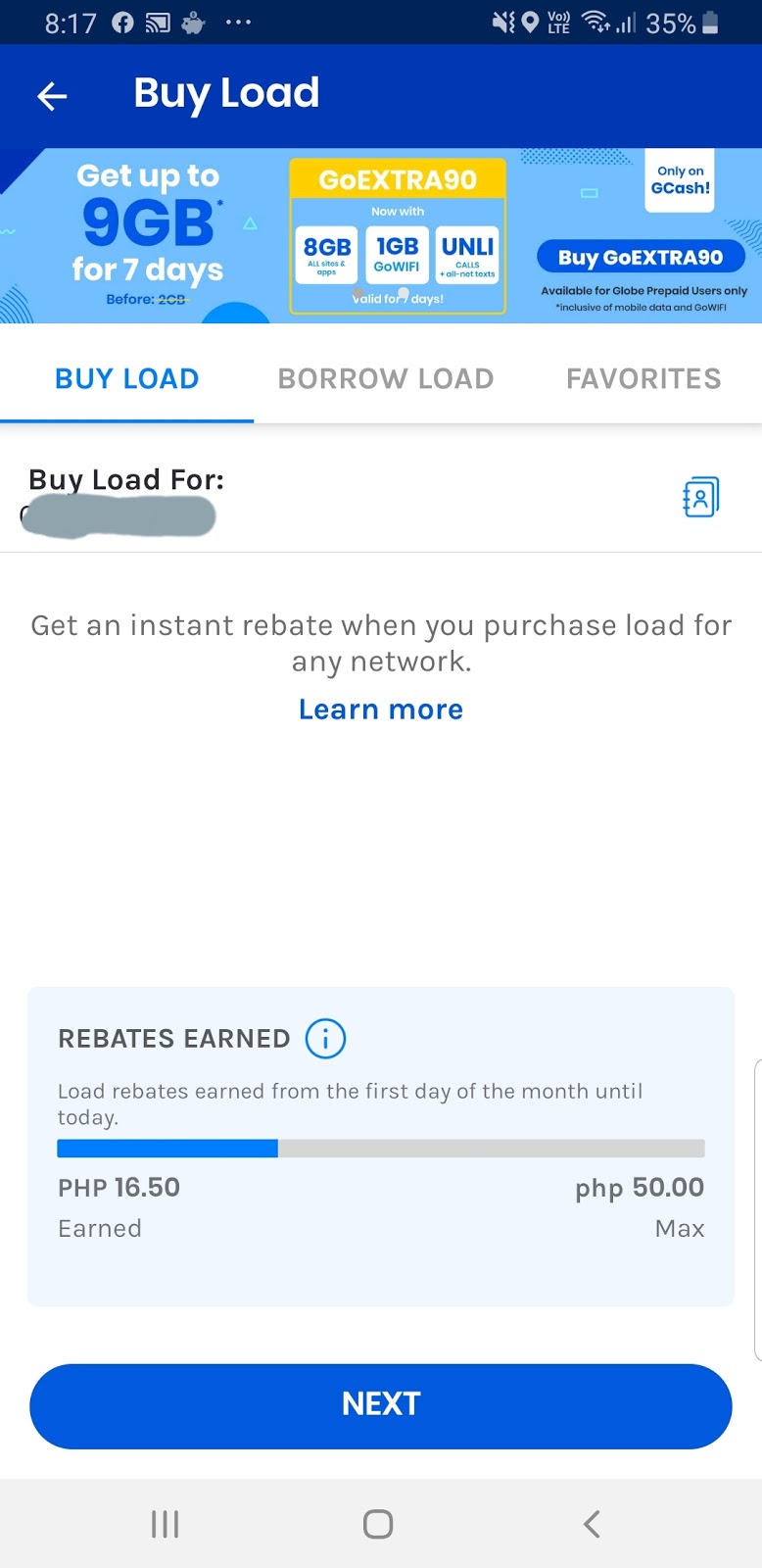

The COVID-19 pandemic forced our country to expedite the assimilation of electronic commerce or e-Commerce. All government institutions and instrumentalities are being required to implement online transactions and online payment to help with social and physical distancing so as to prevent the spread of the virus. Electronic wallets or e-Wallets is now at the forefront of the e-Commerce transaction, allowing for contactless payment, and online payments that you could do anytime and anywhere. Among the e-Wallets available are GCash, Paymaya, Grabpay, Paypal and Coins.Ph. I currently have all of them on my mobile device so that I can make an honest assessment based on my experience using their mobile app. 1. GCash - GCash is an e-Wallet supported by Globe Telecoms, In my opinion GCash is the best electronic wallet in the Philippines. It provides multiple easy cash-in methods some of which you can avail for free. My favorite cash-in method is the BPI online link, which allows me to transfe...